Learning to trade forex can be daunting for beginners, but don’t worry! This article will help you get started with forex trading. We’ll cover real-life examples, basic principles, beginner strategies, and tips for success, along with a step-by-step guide to get you on your way.

Forex trading involves speculating on currency price movements with the goal of making a profit. While many currency conversions on the forex market are for practical purposes, some traders aim to capitalize by correctly predicting these price movements.

To kickstart your journey into forex trading, follow these simple steps:

Open a Trading Account: Choose between a live account or a demo account to start trading on the price movements of forex pairs. You can do it here:

By following this guide, you’ll be well on your way to becoming proficient in forex trading. Remember, practice and continuous learning are key to mastering this skill. Happy trading!

Are you ready to dive into the world of Forex trading? Whether you’re a seasoned trader or a newbie, having a solid strategy is key. Here’s a step-by-step guide to help you navigate the process and make informed decisions.

Step 1: Start Your Research

Begin by identifying the FX pair you want to trade. Utilize our comprehensive news and analysis section to stay updated on market news that could impact Forex. Additionally, keep an eye on our market calendar to stay informed about events that might move the market.

Step 2: Make Your Decision

Based on your research, decide whether you want to buy or sell. Ask yourself: Is the base currency (the first-named currency in the pair) likely to weaken or strengthen? If you believe it will strengthen, go long and ‘buy’. If you think it will weaken, go short and ‘sell’.

If you don’t know how to start, you can follow up our strategies made by our expert Petar Jaćimović on the FXC TV page.

Step 3: Follow Your Strategy

Before placing a trade, make sure you’ve followed your established strategy. This should include robust risk management techniques. Don’t miss our tips on building a strong trading plan to ensure you’re on the right track.

Step 4: Place Your Forex Trade

Execute your trade in line with your strategy, ensuring you have clearly defined entry and exit points. Always use risk management tools, such as take-profit or stop-loss orders, to protect your investments.

Key Points to Remember:

- Stay updated with market news and calendar events.

- Base your decision on thorough research.

- Follow a well-defined strategy including risk management.

- Use take-profit and stop-loss orders to manage risk.

By following these steps, you’ll be well on your way to making informed and strategic Forex trades.

Reflecting on your trades is a crucial step in enhancing your trading skills. Once you have followed your trading plan and exited the market at your forecasted limits, take some time to evaluate your performance. This reflection will help you improve with each trade you make.

Forex Trading Examples

When trading on the forex market, you are essentially betting on the strength of one currency against another. For instance, if you go long and ‘buy’ USD/GBP, you are speculating that the US dollar will increase in value relative to the British pound. Conversely, if you go short and ‘sell’ EUR/AUD, you are speculating that the euro will weaken compared to the Australian dollar.

Example trades can be incredibly useful for learning the intricacies of forex trading. Our forex trading examples illustrate the process of opening and closing a trade position, as well as how to calculate the associated profit.

Forex Basics

Understanding the basics of the forex market is essential for any forex trading beginner. Familiarize yourself with the fundamental concepts and terminologies to build a strong foundation for your trading journey.

- Understand currency pairs and how they are quoted.

- Learn the difference between going long and going short.

- Get to know the main factors that influence currency prices.

By mastering these basics, you will be better equipped to navigate the forex market and make informed trading decisions.

Understanding the fundamentals of the foreign exchange market is essential for making informed decisions in currency trading. This guide will walk you through the key aspects of the forex market and help you navigate your trading journey effectively.

The Foreign Exchange Market

The foreign exchange market, often referred to as Forex, foreign exchange, or simply FX, is the global marketplace where companies, banks, individuals, and governments exchange currencies. It is the most actively traded market in the world, with over $5 trillion traded on average per day.

Currency Pairs

In the forex market, currencies are traded in pairs, which are categorized into three main types:

- Major Currency Pairs

- Minor Currency Pairs

- Exotic (or Emerging) Currency Pairs

The US Dollar’s Dominance

The US dollar is the most popular currency in the world, making up approximately 60% of all central bank foreign exchange reserves. It’s no surprise that the US dollar features prominently in many of the ‘majors’ (major currency pairs), which account for 75% of all forex market trades.

By grasping these basic concepts, you’ll enhance your understanding of the forex market, positioning yourself to make well-informed trading decisions.

As a beginner in the world of forex trading, focusing on the major currency pairs might be a wise choice. These pairs are known for their high liquidity and lower volatility, making them more manageable for novice traders.

Extensive Trading Options

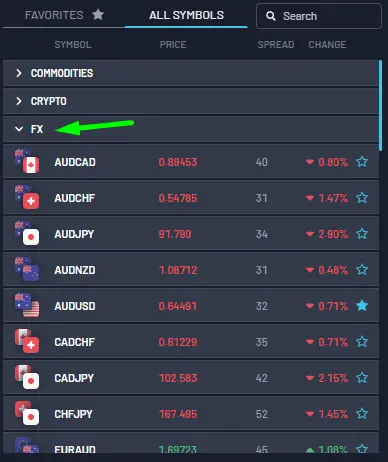

We provide opportunities to trade on over 50 FX pairs, accessible through our FXC Trader Platform. This extensive range allows you to diversify your trading portfolio and find pairs that suit your strategies and risk tolerance.

Understanding Forex Leverage

When you trade forex through a spread betting or CFD trading account, you can utilize leverage. This means you only need to deposit a fraction of the full trade value to open a position, a concept known as trading on margin. However, it’s crucial to recognize that your market exposure is based on the full trade value, not just the margin. Thus, both your potential profits and losses are magnified. Understanding leverage is key to successful forex trading.

Key Points About Forex Leverage:

- Leverage allows you to control a larger position with a smaller initial investment.

- Market exposure is based on the full trade value, not just the margin.

- Both potential profits and losses are amplified.

Trading Holds (Swap)

In forex trading, a swap overnight refers to the interest paid or received for holding a position overnight. This swap rate is applied to positions that remain open past the close of the trading day (usually around 5 pm EST). The swap is the result of the difference in interest rates between the two currencies being traded in the pair.

Here’s a more detailed explanation of how it works:

How Swap Overnight Works

Interest Rate Differential:

Every currency has an associated interest rate set by the country’s central bank. When trading forex, you’re effectively borrowing one currency to buy another. The swap overnight rate is determined by the difference in interest rates between the two currencies in a pair.

Long and Short Positions:

- Long Position (Buy): If you buy a currency pair, you’re holding the base currency (the first currency in the pair) and selling the quote currency (the second currency). If the base currency has a higher interest rate than the quote currency, you might receive a positive swap. Conversely, if the base currency’s interest rate is lower, you would pay a negative swap.

- Short Position (Sell): If you sell a currency pair, you’re selling the base currency and buying the quote currency. If the quote currency has a higher interest rate than the base currency, you might receive a positive swap. If it has a lower rate, you would pay a negative swap.

Calculation and Application:

The swap is calculated based on the notional amount of the position, the interest rate differential, and the number of days the position is held. The calculation is typically done at the end of the trading day.

The result can be either a debit or a credit to the trader’s account, depending on whether the swap is positive or negative.

Example

Let’s say you’re trading the EUR/USD pair:

- Base Currency (EUR) Interest Rate: 0.5%

- Quote Currency (USD) Interest Rate: 2.5%

- Long Position: You buy EUR/USD. Since the interest rate for the USD (quote currency) is higher than the EUR (base currency), you would generally pay a swap, as you’re effectively borrowing a higher interest rate currency to buy a lower interest rate currency.

- Short Position: You sell EUR/USD. In this case, since you’re selling the lower interest rate currency (EUR) to buy the higher interest rate currency (USD), you would typically receive a swap.

Buy and Sell Positions

When you hold a buy position, a holding cost is typically credited to your account. On the other hand, if you hold a sell position, the holding cost is usually debited from your account. Understanding this distinction can help you better manage your trading strategy and expenses.

Beginner Forex Trading Strategies

Starting out in forex trading can be overwhelming, but employing the right forex trading strategies can make a significant difference. These strategies are generally categorized by timeframe and market-specific variables. Whether you’re trading within minutes or over several days, there’s a strategy that can suit your trading style.

Testing and Choosing Strategies

As a beginner, you have the advantage of testing various forex strategies using a forex demo account. This allows you to measure their relative success rates and determine which strategies are most suitable for you. Additionally, you can experiment with different technical indicators for entry and exit points and blend aspects from several strategies to create a customized approach.

Common Forex Strategies

Here are some popular forex trading strategies you might consider:

- Forex Scalping: This involves holding multiple short-term trades and building profit based on small but frequent winning trades.

- Day Trading: Traders open and close positions within the same trading day, avoiding overnight holding costs.

- Swing Trading: Positions are held for several days to capitalize on expected market movements.

- Position Trading: This long-term strategy involves holding positions for weeks or even months, based on broader market trends.

Remember, the key to successful forex trading is finding a strategy that aligns with your trading goals and risk tolerance. By understanding holding costs and experimenting with different strategies, you can enhance your trading experience and improve your chances of success.

Are you a trader looking to optimize your strategy in the dynamic world of Forex? Whether you’re a day trader or prefer a more balanced approach, choosing the right method can significantly impact your success. Let’s explore two popular strategies: Forex Day Trading and Swing Trading.

Forex Day Trading

Forex day trading might be the perfect fit for those who can dedicate a substantial amount of their time to trading. This strategy is primarily focused on technical analysis. As a day trader, you will:

- Enter and exit at least one trade per day

- Predict daily market movements

- Avoid overnight holding costs

This method is ideal for traders who aren’t comfortable with the extremely fast-paced nature of scalping but still prefer shorter-term trading methods.

Swing Trading Forex

If you’re seeking a balance between fundamental and technical analysis, swing trading might be your best bet. This strategy involves:

- Opening positions for several days

- Aiming to buy at ‘swing lows’ and sell at ‘swing highs’ (or vice versa for short positions)

Less time is spent analyzing market trends compared to other methods, but you will encounter overnight holding costs and the potential risk of market ‘gapping’.

Choosing Your Strategy

Each of these strategies has its unique advantages and considerations. Day trading offers a faster pace with no overnight risks, while swing trading provides a balanced approach with opportunities for more extended market analysis. Assess your trading style, time commitment, and comfort with risk to determine which strategy aligns best with your goals.

Ultimately, the key is to choose a strategy that matches your strengths and trading preferences. Dive in, analyze the market, and start trading with confidence!

Understanding Position Trading

Position trading is a long-term strategy where traders hold their positions for extended periods, often ignoring short-term price fluctuations. This approach is ideal for those who prefer to focus more on market fundamentals and less on frequent technical analysis or constant trade execution.

Is Position Trading Right for You?

If you enjoy spending time understanding the underlying factors that drive market movements and have a long-term investment horizon, position trading might be the perfect fit. This strategy allows you to:

- Focus on market fundamentals

- Avoid the stress of short-term price changes

- Make fewer, but more informed trading decisions

5 Forex Trading Tips for Beginners

Embarking on your forex trading journey can be both exciting and challenging. Here are five essential tips to get you started:

1. Understand the Markets for Both Currencies

Before diving into any trade, it’s crucial to have a solid understanding of both currencies in your pair. Be aware of the macro-environmental forces that could impact the markets you’re exposed to. This knowledge will help you make more informed decisions.

2. Stick to Your Trading Plan

Having a well-defined trading plan is key to success. A plan helps you remove emotions from your trades and allows you to predetermine your entry and exit strategies. Consistency and discipline in following your plan can significantly improve your trading outcomes.

For more detailed strategies and insights, be sure to check out our comprehensive forex trading strategies guide.

3. Developing a Robust Trading Mentality

Trading is not just about placing orders; it’s about continuously improving and understanding your trading psychology. As a beginner, it’s crucial to recognize that this is a work in progress. After each trade, take the time to evaluate what worked and what didn’t. This iterative process allows you to refine your strategies and build confidence over time.

Testing your strategies is a key component in this learning phase. You can utilize a forex demo account to experiment without risking real money. This hands-on experience is invaluable for honing your skills and developing a winning mindset.

4. Follow the Classic Mantra

One of the timeless principles in trading is to ‘cut your losses and let your profits run’. This means not being tempted to take profit at the first sign of a gain, nor being afraid to accept a loss. Stick to your trading strategy and implement strict risk-management conditions. By doing so, you can mitigate the influence of emotions and make more rational decisions.

5. Choosing the Best Trading Partner

Your choice of a trading partner can significantly impact your trading experience. Here are some key factors to consider:

- Reliable Trading Platform: Ensure the platform is user-friendly and offers the features you need.

- Customer Service: Responsive and knowledgeable support can be a lifesaver, especially when you encounter issues or have questions.

- Consistent Spreads: Look for platforms that offer competitive and consistent spreads to maximize your profits.

By carefully selecting a trading partner that meets these criteria, you can create a more seamless and enjoyable trading experience. For that reason, many traders have started their trading journey with FXCentrum.

Why Traders Choose FXCentrum

Trading with FXCentrum offers a multitude of advantages. Our platform is designed to cater to both beginners and experienced traders, providing a seamless and intuitive experience.

Where to Trade Forex

You can trade forex through a spread betting or CFD trading account using either desktop or mobile devices. Beyond forex, FXCentrum gives you access to thousands of financial instruments, including:

- Indices

- Cryptocurrencies

- Commodities

- Shares

- ETFs

- Treasuries

Explore our extensive range of markets to diversify your trading portfolio.

Forex Trading Platform

Many beginners find themselves overwhelmed by the vast amount of information on trading platforms and their often complicated interfaces. Our online trading platform is designed with usability in mind. We recommend starting with a demo account to get familiar with opening and closing trades and to practice your trading strategy. You can also personalize the platform to suit your preferences, making your trading experience more enjoyable and efficient.

Forex Mobile Trading App

No matter your level of trading experience, having access to your open positions is critical. Our forex mobile trading app ensures you can monitor and manage your trades on the go, giving you the flexibility and control you need to succeed in the fast-paced world of forex trading.

Ready to take your trading to the next level? Discover why FXCentrum is the preferred choice for traders worldwide.