In this explanation, we’ll break down the details provided in a table for trading the EUR/USD currency pair on our FXC Trader Platform, but this info is basically for all Instruments (each instrument with their own info). We’ll cover key aspects such as what you’re trading, how much it costs, and when you can trade.

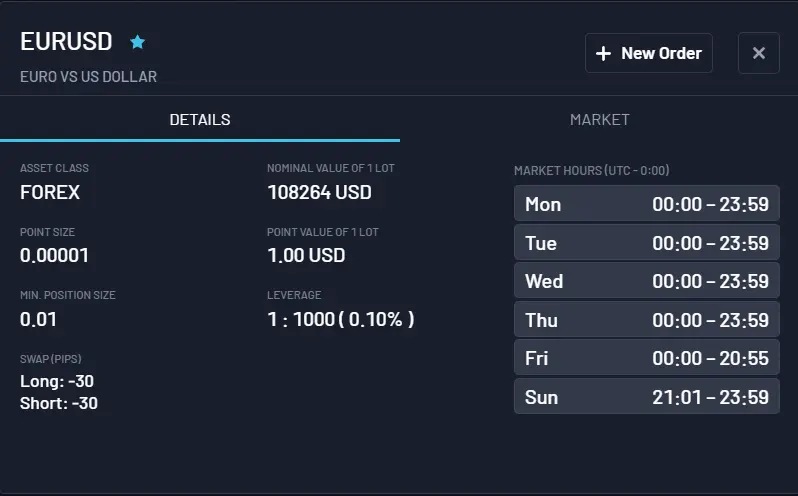

Details Section

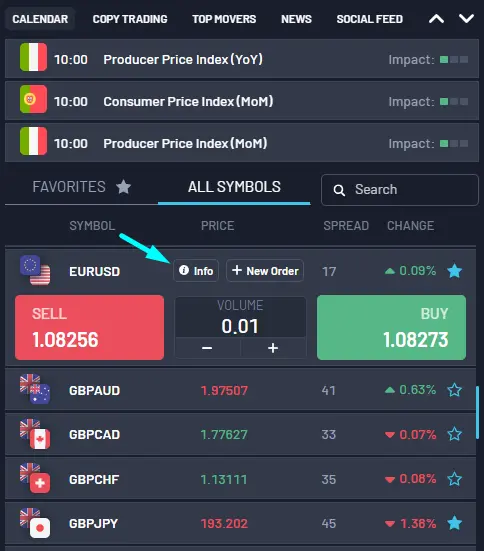

You can find the details of each instrument by clicking on ‘Info‘ in the instrument overview.

By clicking there you will find the next details:

Asset Class: Forex (What You’re Trading)

- This indicates that the trading instrument is a currency pair in the foreign exchange market.

Nominal Value of 1 Lot: 108 264 USD (It Is Different All The Time)

- This is the equivalent value of one standard lot for the EUR/USD pair. It means that 1 lot is worth 108 264 U.S. Dollars in nominal terms.

Point Value of 1 Lot: 1.00 USD (Price Change Impact)

- This specifies that for every 0.0001 change in the exchange rate (which is 1 pip in the Forex market), the value of your position changes by 1 U.S. Dollar per lot.

Leverage: 1:1000 (0.10%)

- Leverage indicates the ratio of the trader’s funds to the size of the broker’s credit. In this case, a 1:1000 leverage means that for every 1 unit of currency the trader deposits, they can trade with 1000 units. The “(0.10%)” notation specifies the required margin percentage, meaning that 0.10% of the trade size must be available as margin.

Point (Minimum Price Movement): 0.00001

- This is likely referring to the minimum price movement increment, which is 0.00001 in this case.

Min. Position Size (Smallest Trade Size): 0.01 Lot

- The smallest amount you can trade is 0.01 lots, which is a tiny fraction of a standard lot.

Swap (Overnight Fees) (Pips):

- Long (Buy): -30 pips

- Short (Sell): -30 pips

- Swap rates are the cost of holding a position overnight, usually expressed in pips. A negative value indicates a cost, while a positive value would indicate a credit. Here, holding either a long (buy) or short (sell) position overnight incurs a cost of 30 pips. In few words, If you hold a position overnight, you’ll pay a small fee of 30 pips whether you’re buying or selling.

Market Section

This part details the market hours in Coordinated Universal Time (UTC) for trading the EUR/USD pair:

- Mon: 00:00 – 23:59

- Tue: 00:00 – 23:59

- Wed: 00:00 – 23:59

- Thu: 00:00 – 23:59

- Fri: 00:00 – 20:55

- Sun: 21:01 – 23:59

These times indicate when the market is open for trading this currency pair. It starts at 21:01 on Sunday and closes at 20:55 on Friday, with continuous trading available through the week, except for a short break on Friday night.